In this article, I am writing in response to a question raised by a friend of mine who read my article in June. His question is when will be the best time to buy or when will the market find its bottom in the next downturn.

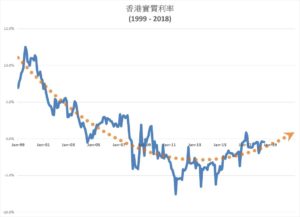

As mentioned in my last article, the key market uncertainty is the potential return of deflation which will push up real interest rates and hurt real estate prices. Although we are still in an inflationary environment, the knock-on effect of “Brexit”, capital flight to safe havens and the softening of the local pillar industries (e.g. retail, logistics and financial services) are actually concomitant with the move away from sustained price inflation.

Back to the market timing, Princeton Economic Institute suggests the global economy to take an average of 8.6 years to run a complete cycle. In the case of Hong Kong, remember that the last trough of the local real estate market was in the middle of 2010. Using the same model, the next trough is expected to happen sometimes in 2019. However, we all understand that it is basically impossible to catch the ultimate market bottom. The point here is that the two-year consolidation period starting 2017 will present a lot more opportunities for prospective buyers. Are you ready to take the plunge?

By the way, I am not superstitious, but coincidentally enough the previous years marked the beginning of a major consolidation were 1987, 1997 and 2007 in the past three decades. They all come with a “7” in their last digit. Coming up next is 2017!

To read more from Simon Lo on Facebook, please click the following.

www.facebook.com/realtythinktanks

Read on for Chinese version.

香港房地產:2017年大調整期前的預警

首先,感謝大家對我的支特,藉此,我想回應其中一位讀者的提問,內容是源於我在六月發表的文章,當中討論到何時是買樓的好時機,希望藉此機會再為大家提供多一點線索和意見,在下一個市場調整期來臨之前,能夠作出適當部署; 究竟何時是市場的大調整期和將會歷時多久呢?

正如我在六月的文章指出, 市場最大的不確定性是未來的通縮風險,因為實質利率將被推高,繼而令房地產價格下調。雖然現時我們仍然處於通脹的環境下,但最近英國 “脫歐” 後的後遺症, 資金相繼作出避險行動,加上本地的支柱產業例如: 零售,物流和金融服務等, 都出現不同程度的軟化跡象,這都預示資產降溫的勢頭。

事實上, 市場是週期性的,筆者參考普林斯頓大學經濟研究所的分析,文獻指出全球經濟週期平均歷時8.6年。在香港, 剛過去的房地產市場週期是在2010年中見底,套用以上的週期模型,下一個市場大週期谷底預計會在2019年出現; 眾所週知,完全捕捉市場的底點是基乎不可能的,但這裡的關鍵是調整期, 若市場出現兩年的調整期,2017年起將會為準買家提供更多的機會; 大調整期將至, 你已作好部署了嗎?

順帶一提, 歷史是不斷重演的,事有湊巧,在過去的三十年中,房地產市場開始出現大調整的年份分別是1987,1997和2007年,它們最後的數字都是”7”, 2017會否是例外還是同出一轍呢? 大家拭目以待吧。

To read more from Simon Lo on Facebook, please click the following.

www.facebook.com/realtythinktanks